Is 8% enough?

1st November 2013

The final level of contributions under pension auto-enrolment is probably too low, according to one leading pensions organisation.

Last month marked the first anniversary of pension auto-enrolment, which is gradually being rolled out across the UK employed workforce, starting with the largest employers. So far take up has been better than many had predicted, with less than 1 in 10 employees opting out after auto-enrolment, according to the DWP.

The low opt out rate probably reflects the efforts which have put into the process by the major employers – like the supermarkets and banks. However, another factor could well be the current level of contributions: the minimum total contribution (employer and employee) in 2013/14 is 2% of band earnings (annual earnings between £5,668 and £41,450). If the employer pays just their required 1%, the most an employee’s outlay will be is £23.85 a month after basic rate tax relief.

Total contributions are set to rise to 5% (2% employer minimum) in October 2017 and 8% (3% employer minimum) a year later. Thus, if an employer limits contributions to the legal floor, in five years’ time their employees’ contributions would be five times the current level.

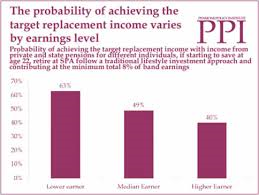

Whether that will prompt a rise in opt out rates remains to be seen, but there are already voices saying the 8% total is not enough. The latest is the Pensions Policy Institute (PPI), which has used a statistical model developed by King’s College, London to look at the chances that the combination of auto-enrolment and the forthcoming single tier state pension will provide an adequate retirement income. Its main conclusion was that for a median earner, a contribution of 8% of band earnings throughout their working life will give them “less than fifty-fifty chance of achieving an adequate retirement income.”

The PPI’s research echoed the findings of DWP work in the same area of retirement income adequacy. In particular the PPI said that higher earners need to contribute more than median and low earners because the proportion of their final earnings presented by the single-tier pension is that much less. Their calculations are shown in the chart below.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.